World Market Entry Table: A Comprehensive Guide

Entering a new international market represents a significant undertaking for any business. Success hinges on meticulous planning, thorough research, and a well-defined strategy. A critical tool in this process is a world market entry table, which serves as a centralized repository for data and analysis, guiding decision-making at each stage. This article delves into the purpose, components, and application of a world market entry table, providing a framework for navigating the complexities of global expansion.

The primary function of a world market entry table is to organize and streamline the market entry process. It acts as a single source of truth, consolidating essential information related to various target markets. This centralized approach facilitates a more efficient and informed decision-making process, reducing the risk of oversight and promoting a cohesive strategy. By analyzing the data presented within the table, businesses can effectively evaluate the potential of different international markets, identify potential challenges, and formulate appropriate entry strategies.

A well-structured world market entry table can be instrumental in answering key questions related to international expansion. It helps businesses to determine which markets offer the most promising opportunities, which entry strategies are most suitable for specific markets, and what resources will be required to execute the chosen strategy effectively. More importantly, it provides a comparative analysis, highlighting the relative strengths and weaknesses of different market options, allowing for a data-driven approach rather than relying solely on intuition or anecdotal evidence.

Key Point 1: Components of a Comprehensive World Market Entry Table

The effectiveness of a world market entry table depends on its thoroughness and the relevance of the data it contains. Several key components should be included to ensure a complete and useful analysis. These components can be broadly categorized into macroeconomic factors, market-specific factors, and company-related factors.

Firstly, macroeconomic factors are crucial for understanding the overall economic health and stability of a target market. This section should include data points such as Gross Domestic Product (GDP) growth rate, inflation rate, unemployment rate, and exchange rate volatility. These indicators provide a general overview of the economic environment and can help assess the potential for economic growth and investment returns. For example, a market with high GDP growth and low inflation might be considered more attractive than one with stagnant GDP and high inflation.

Political stability is another critical macroeconomic factor. Information on the political system, government policies, and levels of corruption should be included. Political instability can significantly increase the risk of investment and disrupt business operations. A stable political environment, on the other hand, provides a more predictable and favorable business climate. Furthermore, understanding the legal framework, including regulations related to foreign investment, taxation, and intellectual property protection, is essential for evaluating the legal feasibility of market entry.

Market-specific factors delve into the characteristics of the industry and consumer behavior within the target market. Market size, measured in terms of total sales or consumption, is a fundamental consideration. A large market offers greater potential for growth, but it may also be more competitive. Market growth rate indicates the rate at which the market is expanding, providing insights into future opportunities. Understanding market trends, such as changing consumer preferences, technological advancements, and emerging business models, is crucial for adapting products and services to local needs.

Competitive analysis is an indispensable component of the market-specific factors. Identifying the major competitors, their market share, their strengths and weaknesses, and their pricing strategies provides valuable insights into the competitive landscape. This analysis helps businesses to differentiate their offerings and develop a competitive advantage. Moreover, understanding the distribution channels available in the target market is crucial for reaching the intended customer base. The effectiveness and cost-efficiency of different distribution channels, such as wholesalers, retailers, and online platforms, should be thoroughly evaluated.

Consumer demographics, including age, income, education, and lifestyle, are essential for understanding consumer behavior. This information helps businesses to tailor their marketing messages and product offerings to the specific needs and preferences of the target audience. Cultural factors, such as language, religion, and social customs, can also significantly impact consumer behavior. A deep understanding of the local culture is essential for avoiding misunderstandings and building strong relationships with customers.

Finally, company-related factors focus on the internal capabilities and resources of the business. This section should include an assessment of the company's financial resources, technological capabilities, human capital, and brand reputation. The availability of sufficient financial resources is crucial for funding the market entry process, including market research, product adaptation, marketing campaigns, and operational expenses. The company's technological capabilities should be assessed to ensure that it can effectively compete in the target market and adapt to local technological standards. Skilled employees with international experience and language proficiency are essential for managing the complexities of global operations. A strong brand reputation can provide a significant advantage in a new market, building trust and attracting customers.

Key Point 2: Applying the World Market Entry Table for Strategic Decision-Making

The information compiled in the world market entry table serves as the foundation for strategic decision-making regarding international expansion. The data must be carefully analyzed and interpreted to identify the most promising market opportunities and formulate effective entry strategies. This process involves several key steps, including market prioritization, entry mode selection, and resource allocation.

Market prioritization involves ranking potential target markets based on their attractiveness and feasibility. This assessment should consider the various factors included in the world market entry table, such as market size, growth rate, political stability, and competitive intensity. A scoring system can be used to assign weights to each factor based on its importance to the business. The markets with the highest scores are considered the most attractive and should be prioritized for further investigation. It is also prudent to consider the level of risk associated with each market and adjust the prioritization accordingly. For instance, a market with high potential but also high political risk might be assigned a lower priority than a market with moderate potential and low risk.

Entry mode selection is a critical decision that determines how the business will enter the target market. Several entry modes are available, each with its own advantages and disadvantages. These include exporting, licensing, franchising, joint ventures, and foreign direct investment (FDI). Exporting involves selling products or services directly to customers in the target market or through intermediaries such as distributors or agents. Licensing involves granting a foreign company the right to use the company's intellectual property, such as patents, trademarks, or copyrights, in exchange for royalties. Franchising involves granting a foreign company the right to operate a business under the company's brand name and using its business model. Joint ventures involve partnering with a local company to establish a new business in the target market. FDI involves investing directly in foreign facilities, such as manufacturing plants or retail stores.

The choice of entry mode depends on several factors, including the size and growth rate of the market, the level of competition, the regulatory environment, and the company's resources and capabilities. Exporting is generally the least risky entry mode, but it may also offer the lowest potential returns. FDI is the most risky entry mode, but it may also offer the highest potential returns. Licensing and franchising can be attractive options for companies that lack the resources or expertise to enter a market directly. Joint ventures can be useful for accessing local knowledge and resources. The world market entry table can help to evaluate the suitability of different entry modes for each target market.

Resource allocation involves determining the resources that will be required to execute the chosen entry strategy effectively. This includes financial resources, human resources, and technological resources. A detailed budget should be developed to estimate the costs of market research, product adaptation, marketing campaigns, operational expenses, and other activities. The company should also ensure that it has sufficient human resources with the necessary skills and experience to manage the international expansion. This may involve hiring local employees, transferring employees from the home country, or partnering with local consultants. The company's technological resources should be assessed to ensure that it can effectively compete in the target market and adapt to local technological standards.

Key Point 3: Maintaining and Updating the World Market Entry Table

The world market entry table is not a static document. It must be continuously maintained and updated to reflect changes in the global business environment. This is particularly important given the dynamic nature of international markets, where economic, political, and social conditions can change rapidly. Regularly updating the table ensures that the analysis remains relevant and accurate, providing a reliable basis for decision-making.

The frequency of updates should depend on the volatility of the target markets. For markets that are relatively stable, updates may be required only once or twice a year. However, for markets that are subject to frequent changes, updates may be required more frequently, perhaps quarterly or even monthly. The sources of information used to update the table should be reliable and credible. This may include government statistics, industry reports, market research firms, and academic publications.

Changes in macroeconomic factors, such as GDP growth rate, inflation rate, and exchange rates, should be tracked closely. Significant changes in these indicators can have a major impact on the attractiveness of a target market. For example, a sudden devaluation of a currency can make a market less attractive for exporters. Changes in government policies, such as trade regulations, tax laws, and investment incentives, should also be monitored. These changes can affect the ease of doing business and the profitability of investments. Changes in market-specific factors, such as market size, growth rate, and competitive intensity, should be tracked as well. New competitors may enter the market, existing competitors may gain or lose market share, and consumer preferences may change. These changes can affect the company's competitive position and its ability to succeed in the market.

Updating the competitive analysis involves monitoring the activities of major competitors and identifying any new threats or opportunities. This may involve tracking their marketing campaigns, product launches, and pricing strategies. It is also important to monitor changes in consumer behavior, such as shifts in preferences and adoption of new technologies. This may involve conducting market research, analyzing social media data, and monitoring online reviews. Regularly reviewing the world market entry table ensures that the company is aware of the latest trends and challenges in the international market and can adapt its strategy accordingly. By maintaining an up-to-date and comprehensive world market entry table, businesses can significantly improve their chances of success in global markets.

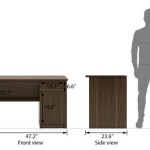

Everett Long Weathered Natural Wood Foyer Table World Market

Everett Short Weathered Natural Wood Foyer Table World Market

Find It For Less Console Table

World Market Round Up Our Perfecting Manor

Sansur Rustic Pecan Live Edge Wood Console Table World Market

A New Entryway Design Furniture Roundup Halfway Wholeistic

World Market Console Table Makeover Painted Black Thetarnishedjewelblog Decor

Odell Reclaimed Pine Farmhouse Console Table World Market

The Everett Foyer Table From World Market Thrifty Decor Diy And Organizing

World Market On Instagram We Re Crushing Over This Neutral Styling Of Our Favorite Everett Table Photo Via Kinandka Foyer Decor Hall Home